Producing a fiscal tax invoice is an important step for every business. It ensures your clients can easily view, verify and scan their invoices for authenticity and ZIMRA compliance.

Before you begin, make sure you have the following:

TIN Number

VAT Number

HS Codes (You can refer to the published HS Code document for guidance)

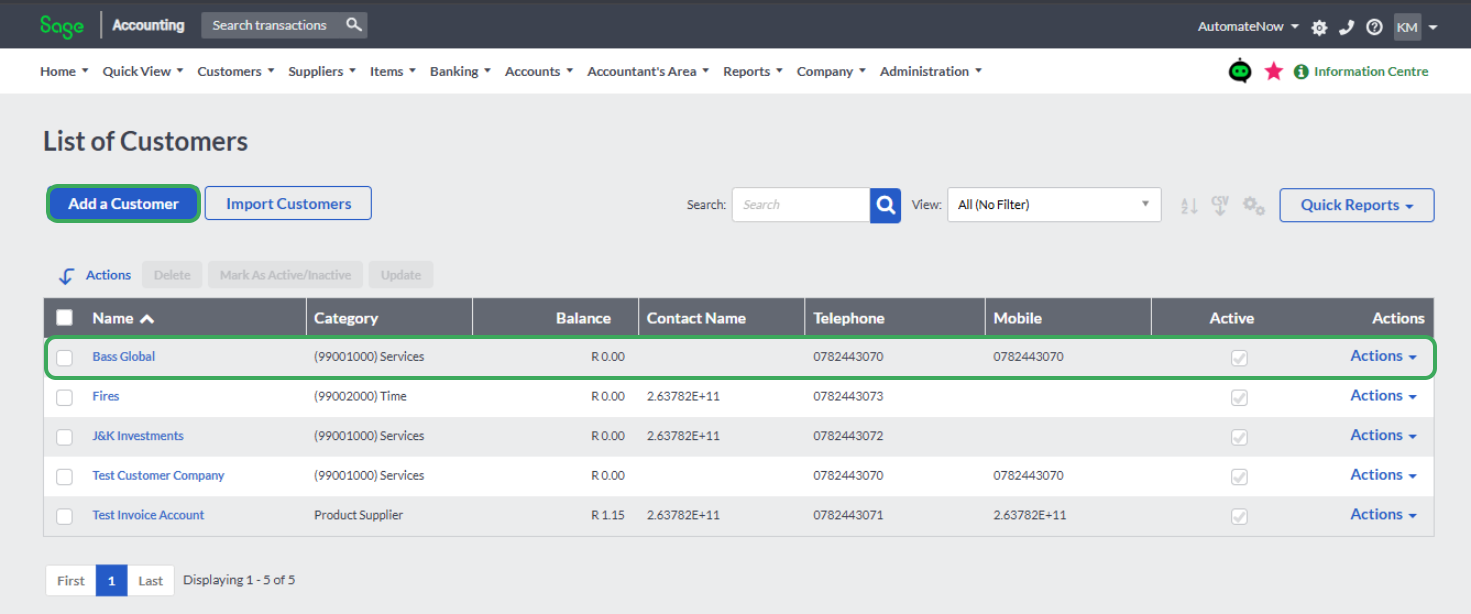

Step 1: Start by logging into your Sage Online account. Once you’re in, navigate to Customers → List → List of Customers. This is where you’ll find all your existing clients.

Step 2: Here, you can view all your customer records. If the customer you want to invoice already exists, simply click on their name. If not, click Add a Customer and fill in their details such as name, contact information, and address.

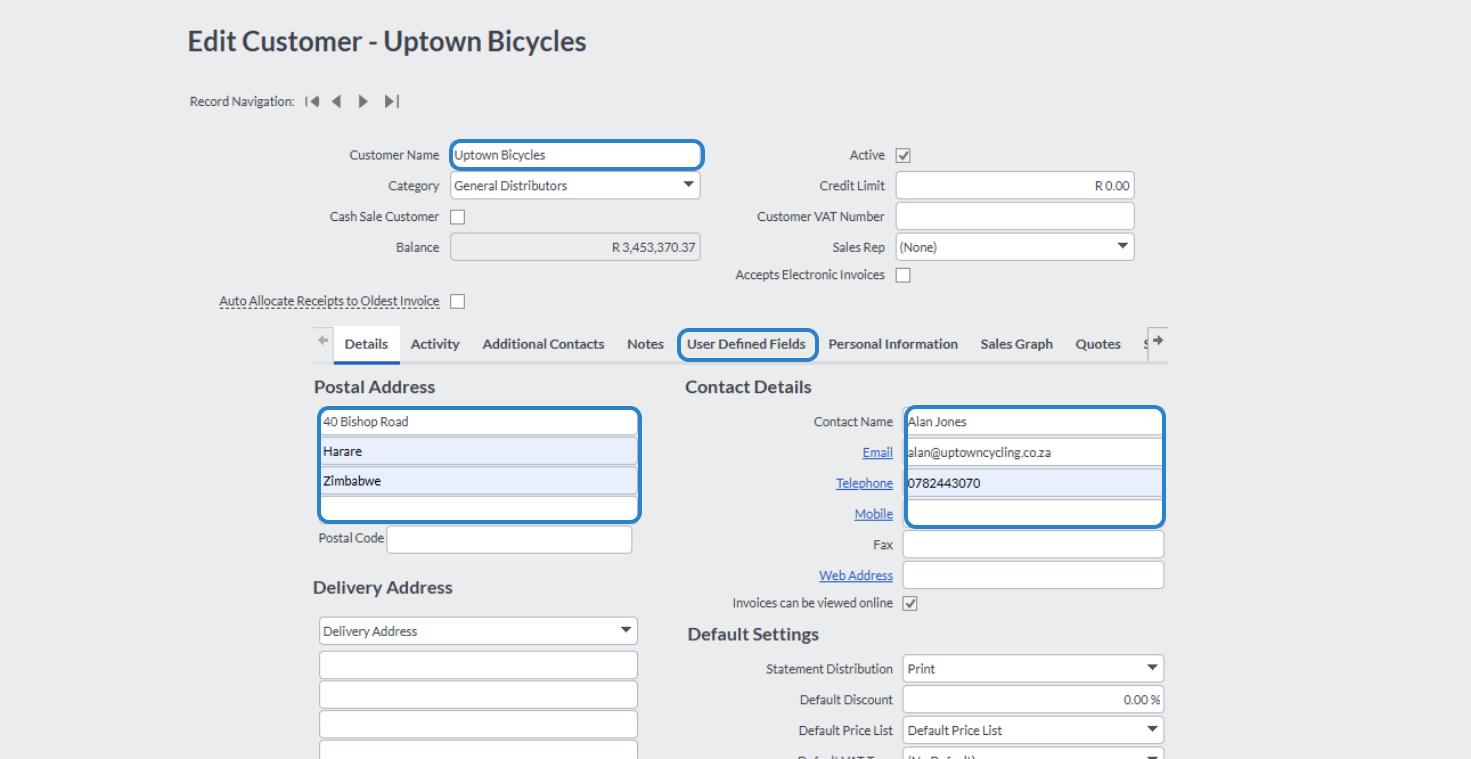

Step 3: When the customer profile opens, check that all the highlighted fields (usually in blue) are properly filled in. This includes key information like their address, phone number, and email address.

Step 4: Next, make sure to add your client’s TIN Number and VAT Number in the highlighted fields. These two fields are very important — without them, the invoice won’t be fiscalized successfully.

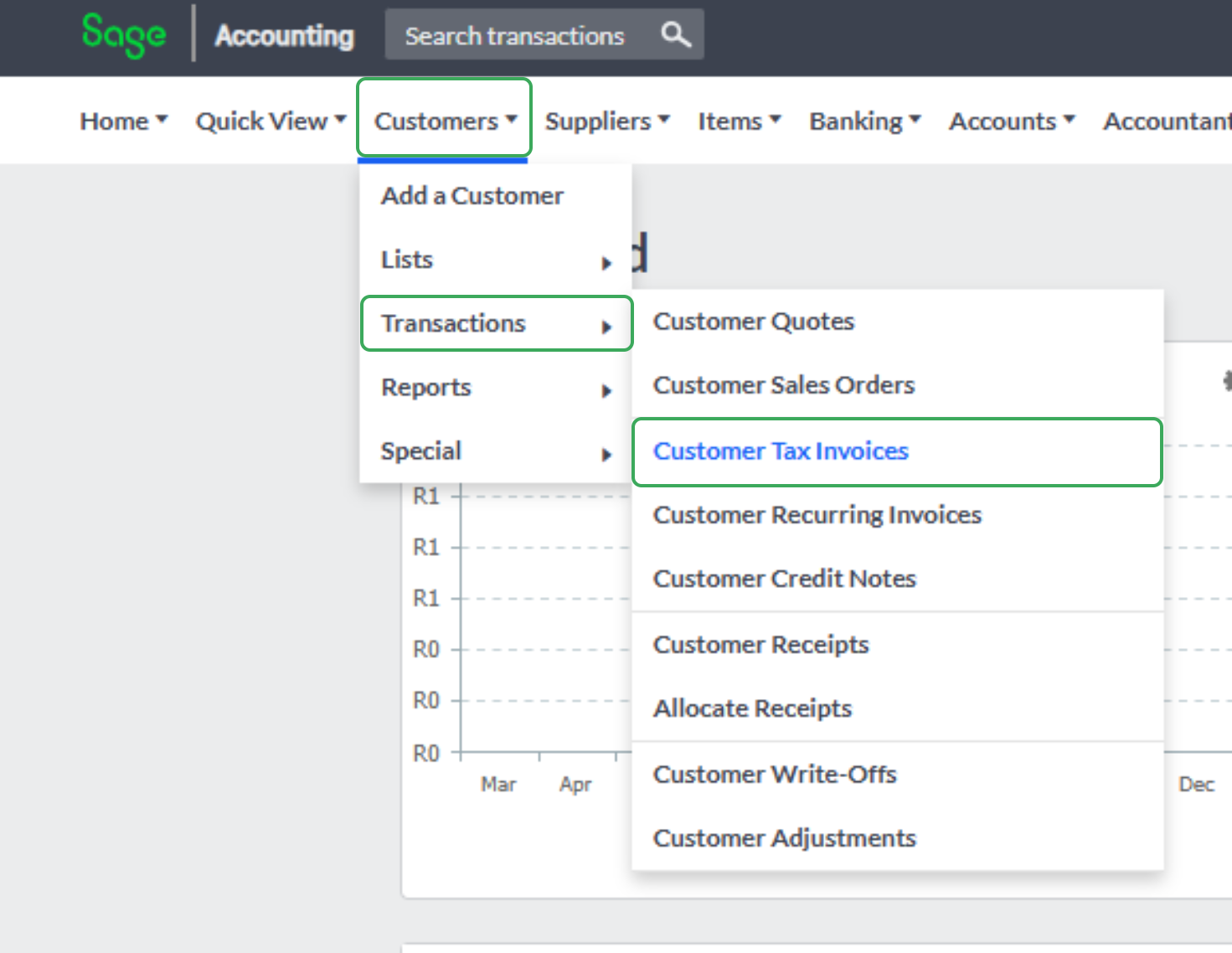

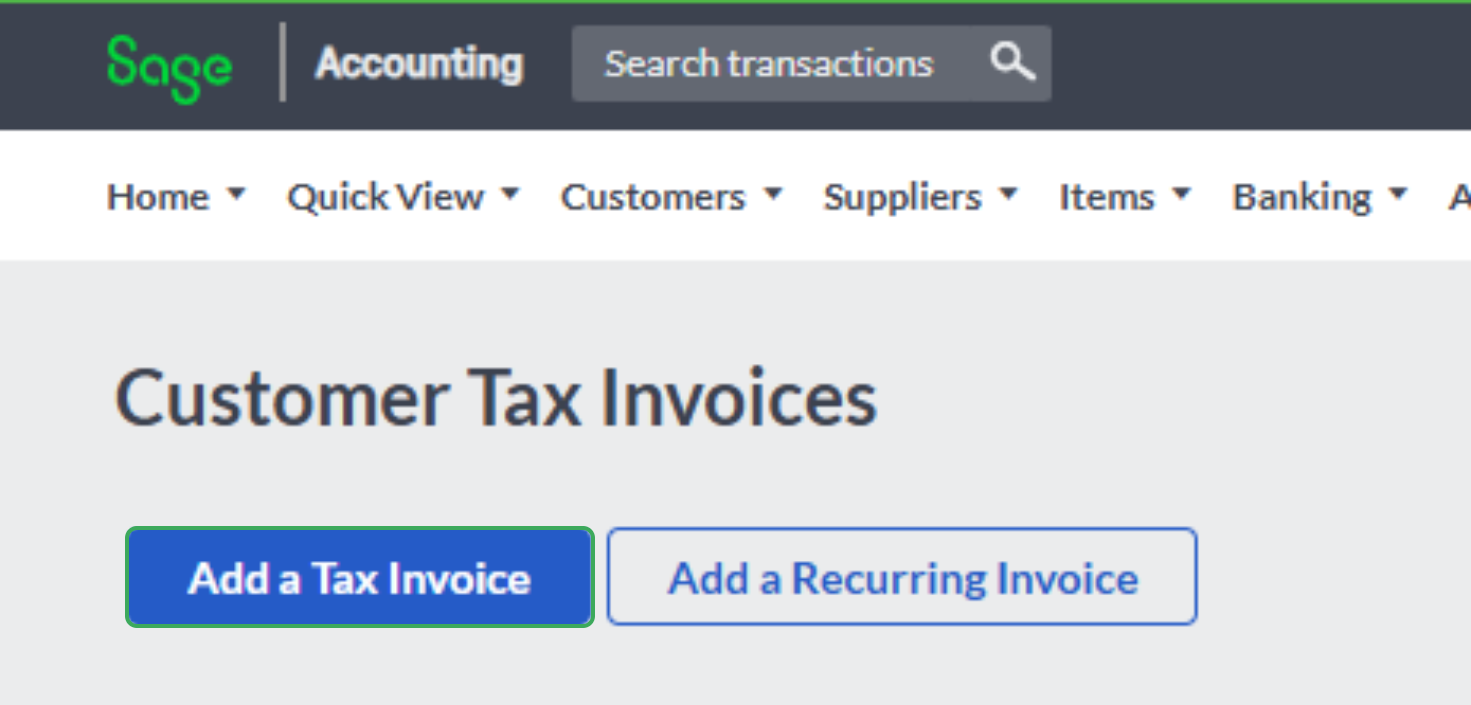

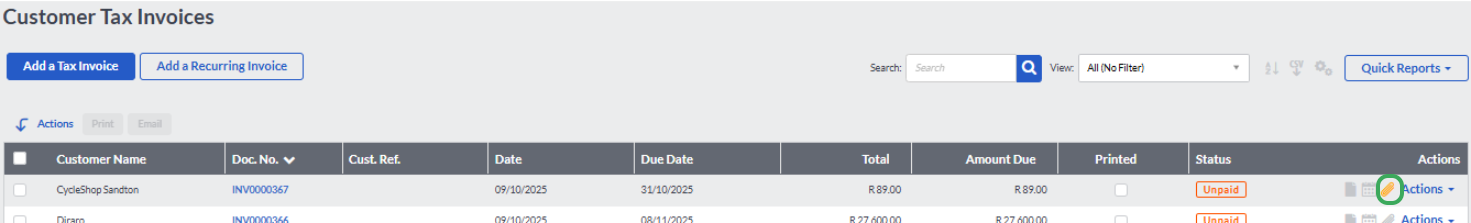

Step 5: Once that’s done, it’s time to create your invoice. Go to Customers → Transactions → Customer Tax Invoices, then click “Add a Tax Invoice.” This will open the invoice form where you can enter all the necessary details.

Step 6: Fill in the invoice details as you normally would, but make sure that each item includes the correct HS Code in the description. Check everything and when you are ready to fiscalize, click Save.

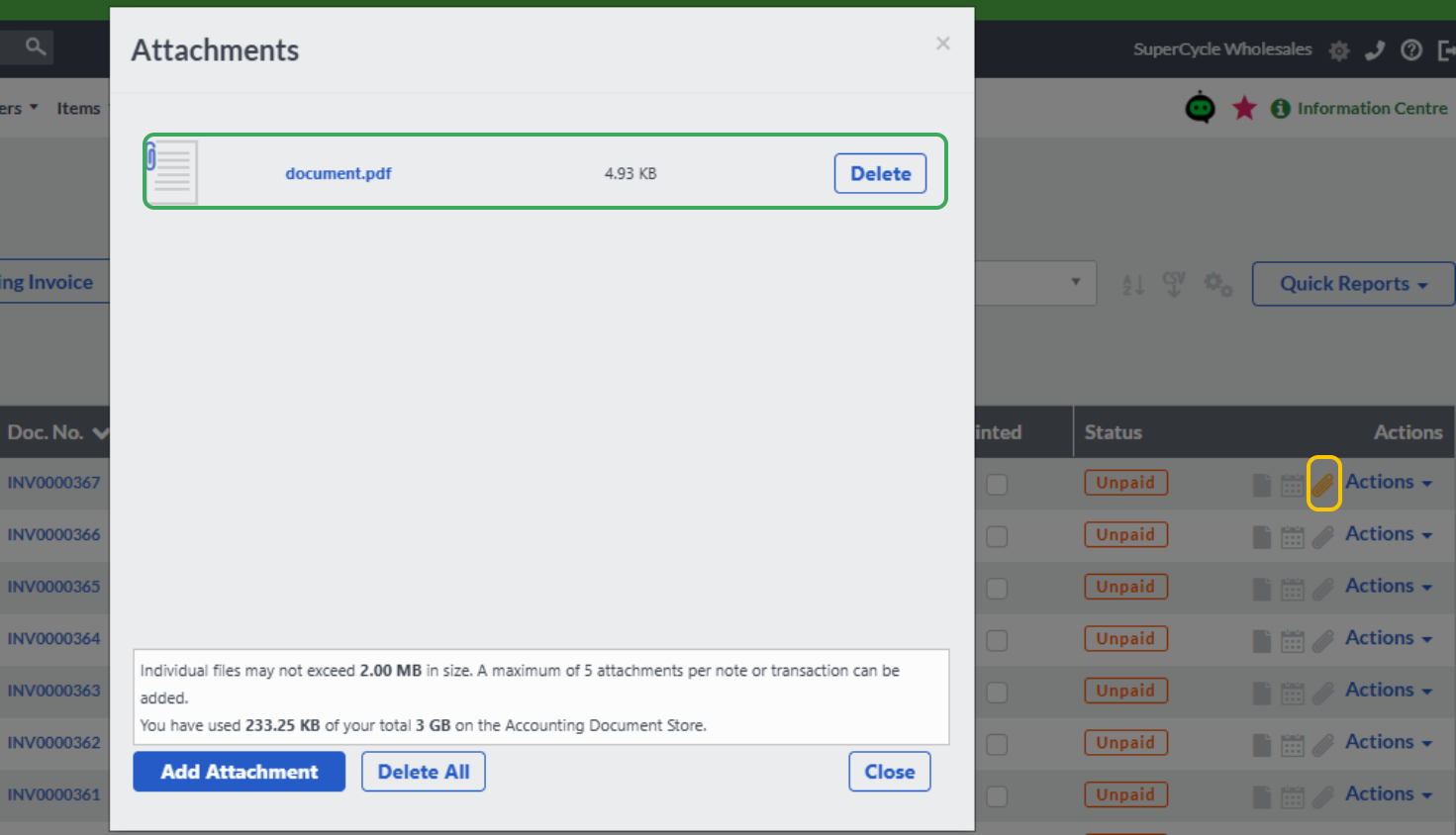

Step 7: After saving, go back to your list of invoices. You should now see your newly created fiscalized PDF invoice attached with a yellow icon.

Step 8: To download your fiscalized invoice, click on the yellow icon next to it. Then select the pin icon, and a pop-up window will appear allowing you to download the fiscalized version of your invoice.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article